Millennials are the up-and-coming power group of society, so it makes sense for any marketer to begin targeting these rising stars for the future of their businesses.

The definition of millennials is still nebulous and not concretely determined, but most people usually take them to mean anyone born between the early 1980s to the early 2000s.

We interviewed marketers from beauty brands that have recently launched a range specifically targeted towards these millennials, in order to find out their thought process behind the conceptualisation of these products.

In order to investigate whether millennials really think the way marketers think they do, we did an informal survey with 67 women that fell into the “millennial” age group to see if their responses and thoughts lined up with marketers’.

This was a casual survey which was meant to be more of a straw poll rather than a statistically rigorous exercise, so we acknowledge the possibility that our results may not be conclusive. However, we hope that it can shed some light on the consumer behaviour of our millennial generation.

Our survey demographics

We surveyed anyone falling between 18 to 37 years of age (with birth years from 1980 to 1999). We also only engaged female respondents.

We initially had 69 respondents. However, there was only 1 respondent each in the 18 to 20 year old age group and the 35 to 37 year old age group, so we decided to exclude them from the analysis, bringing the total respondents to 67.

| Age group | Respondents | Percentage |

| 21 – 24 | 18 | 26.9% |

| 25 – 29 | 36 | 53.7% |

| 30 – 34 | 13 | 19.4% |

Our respondents were mostly consumers with potential spending power, with 89.5% of respondents (60 people) being in the work force from less than one to more than 10 years.

- 1. You have combination skin?

- 1. You’re all about Instagram-worthy packaging?

- 2. You like sleek, minimalist packaging designs?

- 3. You don’t want brands with longer histories, only new and youthful ones?

- 4. You’re more attracted to a product if it says it’s “for millennials”?

- 5. You think a brand is reputable when…

- 6. You prefer this over that?

1. You have combination skin?

Gone are the days when you’re all about zit-zapping, and the drier your skin was, the better. Now your oils are slowly receding and instead of having to deal with oil slicks at the end of the day, you find that helping your skin to find a nice, hydrated balance is more important.

Does that apply to you? Ms Lim Yi Fang, Brand General Manager of Laneige, says, “Combination skin (oily yet dehydrated skin) is a common issue faced by many millennials, especially in hot and humid countries like Singapore.”

Because of this, Laneige recently launched their latest Fresh Calming Line, meant to “empower the skin with fundamental soothing and refreshing moisturisation to regain a healthy skin balance”. Many brands have also acknowledged the greater emphasis on hydration and dealing with combination skin.

Is this true for our millennial-generation respondents?

Verdict: Yup!

A good majority of our respondents, 46.3% or 31 people, said that they have combination skin type, and fell into the category pinpointed by Ms Lim.

1. You’re all about Instagram-worthy packaging?

This is probably the first thing that comes to most people’s mind when talking about millennials. It seems apparent in everyday observation that millennials are willing to spend money in order to take a great picture for social media.

As such, it’s no surprise that brands splash a lot of budget into packaging design in order to capitalise on this fascination with Instagram.

Is this really the case, however?

Verdict: Nope

OK, it’s not very surprising (to us, anyway) that most people weren’t willing to put up with a huge compromise on product quality just for Instagram-worthy packaging. You like your stuff to be pretty, but more importantly, you want stuff to be good as well.

What was surprising to us, however, was that only less than a quarter of respondents (22.4%; 15 people) said that Instagram-worthy packaging was worth a slight compromise in product quality, while a whopping 77.6% said that packaging does not matter at all.

2. You like sleek, minimalist packaging designs?

In general, marketers tended to veer towards minimalist designs in a bid to capture the fascination and visual interest of millennials. “Most of us are visual creatures and we tend to be attracted to designs that align with our own individual image, such as minimalism. Our new WASO range is just that,” said Vanessa Liew, marketing executive of Shiseido.

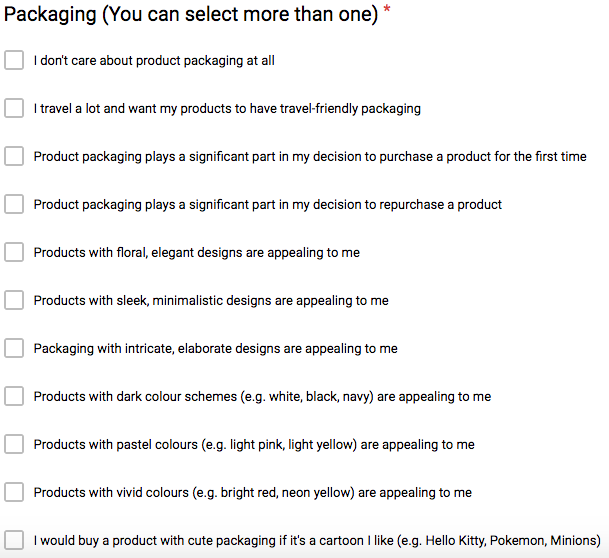

To verify this, we asked our millennial respondents to pick what resonated with them the most, amongst the different types of packaging design.

These are the options that we presented them with:

Verdict: Yup!

These are their responses:

A huge number of respodents (43 people or 64.2% of respondents) picked the option: “Products with sleek, minimalist designs are appealing to me.” Looks like the increasing trend of minimalist design packaging is around for a reason!

It is worthy to note that 23 people (34.3% of respondents) said that product packaging plays a significant part in their decision to purchase a product for the first time.

Of these 23, only four said that product packaging would play a similarly significant part in their decision to repurchase the same product.

We also found that only 20 people (29.9% of respondents) cared about travel-friendly packaging, 17 people (25.4%) liked pastel colours, and only seven people (10.4%) found that vivid colours such as bright red or neon yellow appealed to them.

3. You don’t want brands with longer histories, only new and youthful ones?

Beauty names that have been around for decades and decades may find themselves pressured into rebranding themselves to appeal to a younger crowd. It’s another commonly held notion that millennials aren’t willing to engage with “older” brands (brands with heritage), as they either cannot relate to the brand message, or they simply don’t find the brand trendy enough.

Examples of these “old” beauty brands we were referring to are: Estee Lauder, Elizabeth Arden, Yves Saint Laurent, Shu Uemura, Dior, Chanel, which have a strong and rich history, and are established brands trusted by our mothers, or even grandmothers.

So how necessary is this move? We ask our respondents.

Verdict: Nope

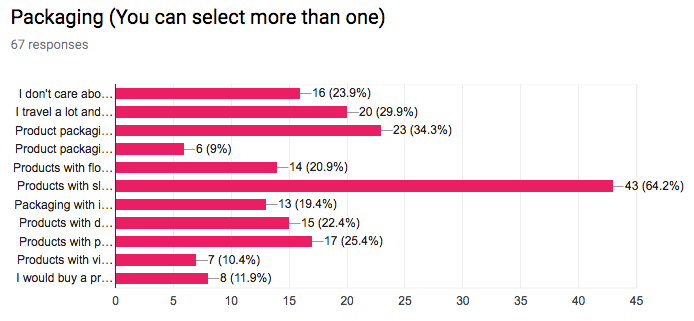

We ask our respondents how willing they would be to try “old” beauty brands that have been around way before they were even born. Would they be willing to try these brands only if they do a revamp of their brand image, or made some attempt to connect to the millennial generation? Or would they be willing to try these brands even if they stay the same as they have always been?

Contrary to our expectations, more than half of our respondents (55.2%; 37 people) said that they would be willing to try beauty brands with a long history even if they haven’t changed much for a long time.

Roughly one-third of our respondents, (31.3%; 21 people) said that they would be willing to try “older” beauty brands, as long as they have made some effort to connect with their generation. Only 3%, or two people, said that they are not interested in “old” beauty brands at all, only “newer” ones.

4. You’re more attracted to a product if it says it’s “for millennials”?

Many brands nowadays no longer hide the fact that they are targeting millennials, and openly acknowledge their intention of marketing towards this consumer group in their publicity materials.

So what do you really think about this though?

Verdict: Sort of true

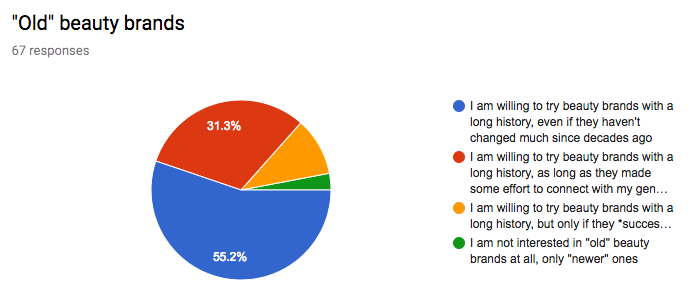

Our respondents were split almost down the middle here. 47.8% of our respondents (32 people) responded that they would not be more willing to buy products marketed “for millennials” as they believe it is only a gimmick.

However, the other 52.2% of respondents (35 people) responded that they would be more willing to buy products marketed “for millennials”, for varying reasons. The most popular reasons for choosing products “for millennials” were that it might be better suited for your skin type, or that it makes you feel connected to the brand.

5. You think a brand is reputable when…

There are many factors that contribute to why we think a particular brand is trust-worthy or not, and we wanted to find out what was the most important. We asked our respondents to pick any of the following choices that might contribute to their perceiving a brand as reputable.

From our survey, the most important factor in a brand’s image as reputable is: “I’ve heard friends in the same-age group talking about them“, with 79.1% of respondents, or 53 people, choosing this option.

This isn’t particularly surprising to us. The word-of-mouth influence has long been known as the most persuasive form of product recommendation. No matter which celebrity has endorsed it, or which beauty influencer has reviewed it, it is really a friend’s review of the product can be that pivotal point which sways people into purchasing it.

Taking second place is “I have seen this beauty brand in Sephora before“. Again, we’re not too surprised here. Sephora is such a haven to us beauty junkies that any brands carried there, even if we’ve never heard of them before, feels automatically like it just got a stamp of quality.

6. You prefer this over that?

We also listed a few pairs of products and asked our respondents to choose which one they’d prefer to use.

Millennial pink vs. well-known

The Glow Recipe Watermelon Glow Sleeping Mask is actually made by a Korean beauty online retailer, and it’s in a beautiful pastel shade of millennial pink. It also reportedly has a waiting list of 5000 people, so we were curious to see if its “millennial” effect worked on our respondents. We juxtaposed it with the not-so-millennial but well-known Fresh Rose Face Mask.

A good majority of our respondents still picked the Fresh Rose Face Mask instead of the Glow Recipe!

Same brand: new, millennial pink vs classic

We then asked our respondents to choose between two Origins product which almost looks the same. The GinZing range is one of Origins’ signature lines, while the Original Skin range is targeted at millennials with “skin in transition”.

According to Jo Purwati, Assistant Sales and Education Manager for the Origins brand, those with “skin in transition” are the generation of people “done with anti-acne products but yet still not ready for serious anti-ageing products”.

Looks like Origins knows its consumers, as 65.7% of our respondents (44 people) chose the Original Skin Mask above the GinZing!

Same brand: millennial range vs classic

Clinique has had a long history (it was founded in 1968) and their bestsellers are made up of classics with packaging that has been looking the same for a long time. Their latest Pep-Start range, however, gave their classic bottles a colourful makeover. But the facelift isn’t just cosmetic. The Pep-Start range “infuses multiple benefits that are more commonly sought after by millennials,” says Jocelyn Chua, Marketing Executive for Clinique.

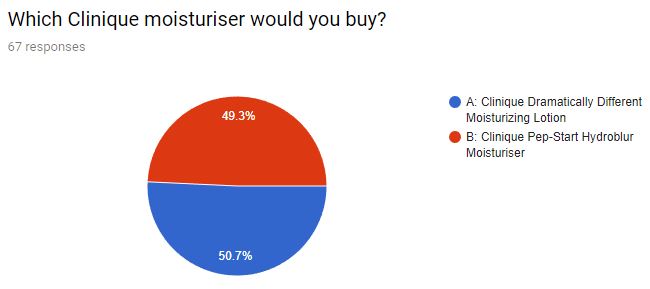

We asked our respondents to choose between two Clinique moisturisers, one a well-known classic, and the other a new and vividly coloured tub from the Pep-Start range.

And the results?

Respondents are almost split down the middle, with 50.7% of respondents (34 people) picking the classic Dramatically Different Moisturizing Lotion, and 49.3% (33 people) picking the Hydroblur Moisturizer.

This could also be because of how new the Clinique Pep-Start range is. The Clinique Hydroblur Moisturizer is said to be able to multi-task, in order to fit in with the busy lifestyles of many millennials. Jocelyn says, “It is a moisturiser that blurs imperfections, hydrates, provides a matte finish, and works amazingly as a primer for makeup.”

Same brand: millennial range vs classic

We did another similar experiment by juxtaposing the Shiseido White Lucent range with its newly launched WASO range, targeted at millennials that like their beauty products to “come from nature”.

The results?

We were pretty surprised by this result. A good majority of our respondents, 65.7% or 44 people, picked the White Lucent range over the WASO range.

The youngest age group surveyed, the 21 to 24 year olds, was the age group that had the highest proportion of respondents picking the WASO range, with 50% (9 out of 18 respondents) of the age group choosing the for-millennial WASO range.

The 25 to 29 year olds and the 30 to 34 year olds had 25% (8 out of 36) and 38.5% (5 out of 13) of respondents picking WASO respectively, while the rest chose White Lucent.

Due to our small sample size, and the informal way the survey was administered, this casual exercise is not meant to provide be-all-end-all conclusions about millennials or their consumer behaviour.

However, we hope that it has been useful in pointing out that there may be differences between common conceptions of millennials and what they really think, in reality.

Were you surprised at some of the responses? Leave a comment below to share with us your thoughts! You can also write us a note at [email protected] if you want to have more insights on the survey we’ve done.

Featured image from here.